Financial Literacy Month

April is officially Financial Literacy Month. I thought it would be the perfect time to raise a bit awareness about the major gap in financial literacy education in American schools.

In my opinion, the lack of financial education today’s kids get, is the major reason you see higher credit card usage and consumer debt. Currently, only 20 states require students to take economics. What’s worse is that number is trending down! It was 22 only a few years ago.

I know when I has in high school, I never had a personal finance or economics class. While I ultimately learned by studying on my own, I think about all of my classmates that never learned basic skills on budgeting or investing.

Junior Achievement

An announcement and quick side note. During the month of April, I’ll be donating 50 cents for each new Facebook like or email subscriber, up to 500 new people. So, like my page and subscribe and that would be a $1 donation. Share this post with your friends and have them like and subscribe as well. I’d love to donate the full $250.

The money will be donated to Junior Achievement, which is an organization focused on helping young people gain the financial knowledge they need to succeed. If you’d like to donate to Junior Achievement directly, you can do so here.

Financial Education

While I was working on this article, I reached out on Twitter to see what others thought were important topics to learn.

What’s the one thing about personal finance you wish they taught in school?

— Average Joe Finance (@avgjoefinance) January 6, 2018

@ValueStockGeek really nailed the sentiment with their response.

Anything because they teach nothing.

— ValueStockGeek (@ValueStockGeek) January 6, 2018

The fact that so few schools provide a solid financial education is a black eye on our education system. The point of going to school is to prepare you to be successful in life. Yes, topics like math, science, and history are extremely important, but so is personal finance.

How can you be successful if you can’t properly manage your money?

The most recent recession really illustrated how dangerous a lack of financial knowledge can be.

People’s excessive use of credit and the creation of incomprehensible mortgage securities caused a major collapse of the US economy. I’m not saying if school’s taught basic economics and finance the recession would have never happened, but I don’t think it would have made it worse.

So, if we were to teach finance in schools, what would be good topics to cover? These are the six things I wish I had learned in school.

How to Balance a Checkbook

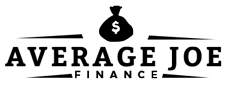

As more and more transactions move digital, people don’t write as many checks, but that doesn’t mean learning how to balance your checkbook is a waste of time.

Understanding how much money you have available is the basic foundation of personal finance. Yet 35 percent of high school seniors claimed that they don’t balance their bank account.

Not properly balancing your bank accounts can lead to bounced checks (which increases your fees) or increased credit card usage. If you ever want to get on the path toward financial independence, learning how to determine how much money you have is the first step.

Plus, it’s easy to do too. Elementary school kids with basic addition and subtraction skills could balance a checkbook. If it’s so easy why aren’t we teaching it?

Compound Interest

@tainted_tiara had a great response.

The magic of compound interest

— Tainted Tiara (@tainted_tiara) January 7, 2018

Compound interest really is financial magic. What other concept is so powerful that with it you have a legitimate path to making millions (or billions if you’re Warren Buffett).

Most people reading this probably understand compound interest, but if you don’t here’s a brief overview. When you invest or save your money in a bank you earn a return. With simple interest, your return is always calculated off of your principal balance.

With compound interest, your returns begin to earn you money as well. So, if you make $100 interest in year 1, during year 2 your principal plus the $100 return will earn interest. Compounding your returns is how you can double your money in 9 years with an 8 percent return, instead of over 12 years with only simple interest.

Understanding the power of compounding helps you think of your money as an asset and not as a way to buy more stuff. You begin to realize how much that daily Starbucks is really costing (link). Or how those seemingly small investment fees could derail your goal of early retirement.

One of my biggest regrets is not learning about this sooner. I didn’t truly stumble upon the concept until I read The Snowball. Reading how Warren Buffett viewed his money completely changed my perspective. From that point on instead of thinking about what I could buy with my income, I started looking at how I could invest it. I looked for ways to cut expenses so I could funnel more money into my investments.

If only I had learned about the power of compounding in school.

Credit Score

Some people may disagree on how important your credit score is, but I think we all can agree that it does have some degree of importance.

Your credit score can impact your insurance rates, ability to get a job or even rent an apartment. Plus, with the increase in data breaches, like the Equifax hack, monitoring your score is all the more important. But this monitoring can be difficult if you don’t understand how a credit report works.

The main issue is that credit scores are confusing. You can add a credit card and your score can go up, but when you close a card it can hurt your score.

To someone who doesn’t understand the different factors, this doesn’t make any sense and can cause a lot of frustration if they’re trying to improve their score.

I won’t get into all the details, but essentially your credit or FICO score is a weighted score based on your payment history, amount of credit available and types of credit used.

Growing up I was told to avoid credit cards and after the recent recession a lot of people think all credit is bad. But this viewpoint is wrong. Taking this stance will actually prevent you from growing your credit history and in turn your FICO score. Instead of learning to avoid credit, I wish I’d learned how to use it responsibility to improve my credit score. This would have helped when it came time to apply for…

Loans

It’s becoming a fact of life that at some point you will have to take out a loan. Whether it be a car loan, student loan or mortgage, taking on a monthly loan payment is a big deal. Yet in school nothing about loans was ever mentioned.

I remember when my wife and I went to buy our first house. I had so many questions about the mortgage.

What information do I need to apply for a loan?

How do I know how much I can afford to pay each month?

How does my credit score impact the process?

Trying to find the answers to these questions on your own can be a daunting task. If I had only learned this stuff in school, it would have been so much easier!

Knowing how much you can afford is probably the number one loan topic I feel like schools should be teaching. This goes back to the idea about balancing your checkbook and knowing how much money you have. Once you know what you have, you can determine what you can afford.

And it’s important to know how much you can pay each month, because what you can afford and what you’re approved for can be completely different.

Banks earn money by selling loans and collecting interest on those loans. So, it’s in their best interest to approve you for as large a loan as possible. A higher balance means more interest each month. But just because a bank will give you the money, doesn’t mean you should take it.

Again, going back to buying our first house, I remember how we qualified for a mortgage $20-30 thousand higher than what I thought we could comfortably afford. Sure, we probably could have afforded the higher monthly payment, but at what cost? That higher payment would have meant less money for things like travel or saving for retirement. Everything has an opportunity cost even if it’s not an explicit one.

Basic Investing

I’ve been consumed with learning about investing since I was 13 and asked my parents to buy me stocks for my birthday.

Most of what I know about investing today was learned from self-study. And if you’ve ever done any research on investing you know there is a TON of information out there. Some of which isn’t even good advice. It took me a lot of trial and error to be able to sift through the bad information, but I’ve gotten better at it over time.

Learning about the basics of investing or getting some introductory resources in school would have the made the whole process less complicated.

I feel like everyone should have a basic understanding of how the stock market works or the difference between a stock, ETF and mutual fund before they graduate high school. Sure, investing can get complicated pretty quickly, especially if you’re talking about derivatives or futures, but these aren’t things schools need to teach.

Most people are hesitant to invest because it seems too complicated or they think the stock market is rigged against them.

Imagine the impact if every high school student had a basic understanding of investing when they graduated?

Learning to invest responsibly and earlier in life could reverse the trend of people not saving enough for retirement. Stocks and mutual funds would no longer be a black box to them. They wouldn’t feel like they needed to be a Wall Street insider or professional trader in order to secure their future through investing.

The Art of Negotiation

Negotiation is a bit of a soft skill (unlike math or science), which is why I think most schools don’t talk about it. But being an effective negotiator is important in many walks of life.

You can negotiate on little things, like where you and your partner will eat dinner, to major purchases like buying a car or house. It’s even helpful during your career when you’re trying to get a raise.

Understanding the importance of being prepared and how to present your stance can help your finances. Knowing tactics that help you pay less or earn more go a long way to putting you on better financial footing.

Plus, you don’t even need to learn to be a great negotiator, just a good one. Even a small raise can add up when you compound that increase over the course of your career.

Negotiating isn’t something that comes naturally to a lot of people. Most people probably don’t even realize the number of things you can and should negotiate on. Even if you’re fresh out of college, that doesn’t mean you should accept the first salary offer you get. Companies expect a little back and forth on pay. Plus, the worst that happens is they say no.

A Better Future

By not teaching basic personal finance, schools have a major hole in their curriculum.

Sure, there is a lot of information online, but without a solid foundation it can be difficult to sort through and understand. Looking back on the mistakes and struggles I had learning on my own, I think about how much easier it would have been had I learned more in school.

What’s one thing about personal finance you wish you learned in school?

Great article! Our kids need to learn all of these skills!!