How are 401K contributions taxed?

This is a question I regularly receive about the tax implications of saving for retirement. Most people understand that contributions to a retirement account have tax advantages, but they often don’t understand what that really means.

401K vs. Roth 401K

The main driver of how your contributions and withdraws are taxed depends on the type of your 401K. A traditional 401K is considered pretax and a Roth 401K is post tax.

Pretax simply means that your contribution is not subject to tax in the year it was made. For every dollar you add to your 401K, that’s one less dollar included in your income for tax purposes.

Roth contributions, on the other hand are considered post tax. This means that you still pay taxes on the money you contribute to your Roth 401K in the year of your contribution. The benefit here is during retirement.

Planning Ahead

When you retire, the decisions you made on your 401K contributions will still impact you. If you made regular pretax contributions, you will have to pay tax on every dollar you withdraw from the account.

Conversely, with a Roth 401K, you don’t pay any taxes on the money you withdraw.

In simple terms, a 401K defers all taxes until retirement, while a Roth 401K incurs taxes while you are working, but then avoids taxes in retirement.

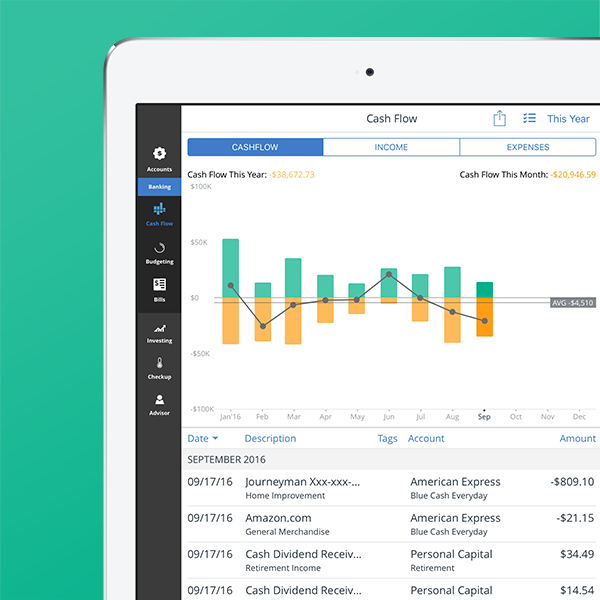

Track Your Net Worth - Sign up for Personal Capital for Free!

Which One is Right For You?

With the maximum 401K contribution being $18,000 in 2017, proper planning can have a big impact on your taxes. It really depends on your situation if you would rather pay tax now or later.

Generally speaking, it’s much better to pay tax on your contributions now and then avoid taxes on your investment gains.

But, if you are in a higher tax bracket it can be beneficial to shift some of your tax liability. The thought here is you’ll be in a lower tax bracket in retirement, so you’ll end up saving. In this case, you’d want to contribute more to a traditional 401K.

Overall, I think it’s a good idea to have a mix of both. That way you can lower your tax liability today (with contributions to a traditional 401K).

Plus, you’ll be able to manage your taxes better in retirement thanks to the ability to withdrawal both taxable and non-taxable income. So, if tax rates go up, you can withdraw more from your Roth contributions. If tax rates drop during your retirement, you can take more from your traditional 401K.

Q&A Series

This post is part of a series of articles ( in which I answer common questions I’ve been asked. If you have a question leave a comment below or contact me directly.

Leave a Reply