The Good Old Days

The Good Old Days

Back in the days before social media and our always-connected society, the term “Keeping up with the Joneses” simply referred to comparing yourself to your neighbor or close friends. If your friend got a new house, all of a sudden, your house didn’t seem so great and you started to think that maybe it was time to upgrade. Of course, if you did end up buying a new house, then probably one of your other friends would start thinking it was time.

A Connected World

Enter social media. Now in an instant, we can easily connect (and if we’re honest, probably obsess) with just about anyone.

A friend of a friend? Now you’re Facebook friends.

That guy you met at a party one time? Now you follow him on Twitter.

You can even follow the trials and tribulations of people’s pets on Instagram!

While all this connectivity can be great, it also has widened our social circle and in turn, widened the group of individuals we compare our lives to.

Keeping Up with the Digital Joneses

It should come as no surprise that the new “Keeping up with the Joneses” is now online. There is even a new term for it: Fear of Missing Out (FOMO). What is surprising is how much it actually influences people.

A recent study by the American Institute of CPAs found that 4 out of 10 US adults with a social media account said that seeing other people’s purchases made them look into a similar purchase themselves. That’s 40%! Around 11% of these individuals actually ended up making the purchase.

Just let that sink in, a little over 1 in 10 people were influenced into buying something just because they saw it on social media.

The Age of Comparison

These results illustrate just how dangerous our online lives can be to our financial lives. Fear can be a powerful motivator and now that we’re so connected, FOMO has become something of an epidemic.

Before social media, it was easier to avoid the trap of making unnecessary purchases because our circle of friends was smaller. We never really worried about missing out

Now every minor acquaintance is a comparison. Even worse, we now have unfiltered access to celebrities who can afford a lifestyle the average American can’t even dream of.

How is someone supposed to compete with that? You Can’t.

The Future is Bleak

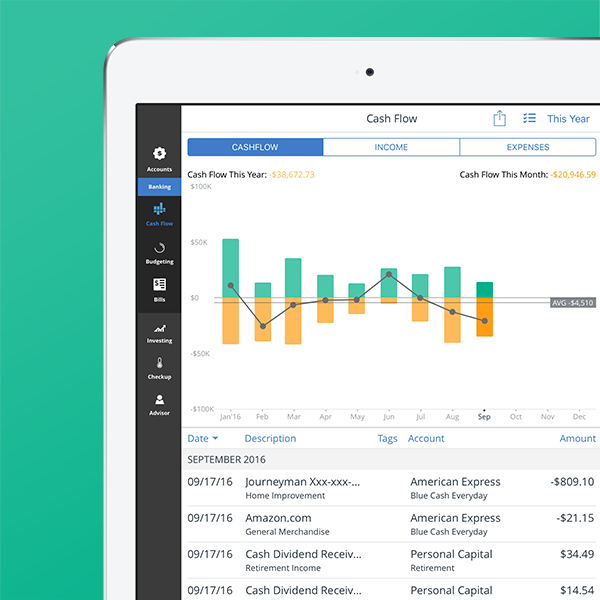

What another recent study by Go Banking Rates found, was that 62% of American have less than $1,000 in savings. Of that 62%, 49% responded as either not having any savings or not even having a savings account!

This study illustrates 1) Americans are clearly overspending on their lifestyle and 2) those people you’re trying to keep up with probably really aren’t much better off than you.

The Downside of Social Media

Let’s start with the first point.

If you’re constantly afraid you are missing out, you won’t be paying much attention to your financial health. The new pair of Air Jordan’s you saw on your friend might seem like a must-have in the moment, but it’s fleeting.

You’d think most people would realize that overspending today will hurt you in the future. That’s true, but humans aren’t very good at estimating future losses. We have a high discount rate, meaning we have a hard time delaying a reward to a future time.

When we see something on social media, all we think about is the present. We aren’t worried about how spending money now will give us less for retirement. Instead, we say, “Retirement’s so far away, I’ll start saving tomorrow.” This is why two-thirds of Americans don’t have $1,000.

False Lifestyles

To my second point, if two-thirds of Americans don’t have $1,000, chances are most of those people you’re comparing yourself to online really can’t afford everything they are buying anyway.

They are probably overextending themselves financially and by copying them you will be following them down a bad financial path.

A healthy savings account doesn’t sound sexy. But you know what does? Being able to travel and enjoy retirement. People who spend and spend won’t be able to do either because they’ll be working into their 80s.

Breaking the Cycle

What can you do to avoid falling into the Jones’ trap? Realize the fear is only in your mind.

Try unplugging a bit.

This can be difficult, but even if you start with one day a week or even a few hours a day you can learn to reduce your dependency on social media. Try leaving your phone somewhere you can’t easily reach it. That way you won’t be tempted by constant alerts.

Another tip is to just tell yourself that what you see online is really an illusion. Next time you see a friend get a new car, just remind yourself you don’t know their financial situation.

Maybe they can afford the car or maybe they are overextended and really should not have made the purchase. Either way, you know that you’re living within your means and in the long run, it will pay off.

Have you found yourself buying something just because you saw it on social media? Let me know in the comments.

I relate to what you wrote in here, sometimes I go on Facebook or Instagram, whatever, and I just see people leaving this lush life and I think: I know how much you earn and I know that your life isn’t all of this so how come? are you in debt or what?

I don’t know, it’s like people just leave for the sake of appearances sometimes. It’s nice to forget our phone or laptop at home sometimes and just enjoy life.

What really gets me is when I’m at a concert or sporting event and everyone is recording it or taking pictures with their phones. Instead of enjoying being their live they are viewing the whole experience through their screens.

Excellent point. I find the more I am “out and about” with my real life friends, the less I find myself in FOMO land or wishing I had more. I’m just having a good time! But it is the late night Instagram scrolling that brings out the “hmmm, I could use that” thoughts.

Great point on how quickly we forget how great a time we just had. I’ve started trying to write down something I’m grateful for each day so when I am scrolling through Instagram or Facebook I can remind myself that I’m not really missing out on much.

Haha and this is why I basically don’t use Facebook anymore. 🙂 I try to compare myself only to myself of yesteryear. If I’m doing better in terms of happiness and net worth thus year than last year, I consider that a success!

That’s such a great way to measure happiness!

Social media has provided us insight into others lives we have never had before and thanks to people presenting themselves in the best light we can become envious. I definitely have to watch my emotions when looking at other people’s posts or I will go on an envy based spending spree! Great post!

Thank you! I think someone should invent a button that prevents you from buying anything for an hour or two after you are on Facebook.

This. Article. Again. And. Again! FOMO is a serious disease which so many people falter to. I recently had a peer cash out his 401K completely to use as a down payment for his house. He had nothing in savings and no cash on hand for the down payment, but felt pressured by seeing other people our age purchasing their first home. I was shocked! The pursuit of FI really does wonders though. I used to experience symptoms of FOMO whenever I logged onto any of my social media accounts, but now when I see peers showing off their lavish… Read more »

Wow! That’s an extreme example of FOMO. I’m with you. I try to think about how my purchased will impact my long-term goals before making any decisions.

Being ever-so-slightly too old to be active on / care about Facebook is a truly wondrous thing!

Couldn’t agree more, Joe. Social media is a big time suck and makes you covetous. It’s even worse than television. Those who can ditch social media have a shot at FI. Those who can’t are doomed to a life of going nowhere on the financial hamster wheel. Great freaking post.

Thank you!

I agree, social media is the devil….an amazing marketing ploy to get people addicted

When you think that 2/3 of people don’t have $1000… I mean, that is kind of crazy! I know it’s an average, and in certain regions there are more no-savings people than in other regions. But. Man. That is sad.

[…] How Facebook is Ruining Your Savings AVGJOEFINANCE.COM […]

[…] is it harmful? (And if you think I’m making any of this up – I absolutely loved that Average Joe Finance shared an article about how much debt Americans are racking up due to digital FOMO. […]